After you set up a plan where the debtor is to pay off the account in installments, you should closely monitor the account, watching for any sign that the debtor is falling behind again. After the payment plan is implemented, remind the debtor that you expect all installments to be paid on time.

Here’s how you can remind your debtor effectively:

- Send statements to the debtor in advance of each payment due date. Restate the due date, amount due, and remaining balance.

- Place reminder phone calls/emails. Remind the debtor that you expect all installments to be paid on time.

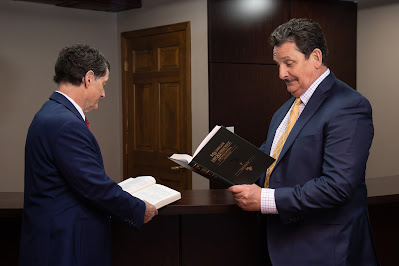

Need a collection company that operates in Michigan?

You’re in the right place!

Your money is our #1 priority. If your or your debtor live in Michigan, our collection company can help! Take the pressure and frustration off your plate by contacting the Mullers at (248) 645-2440 or by submitting a contact form.